Beneteau: Order intake accelerating and dealer inventory stable in the third quarter

“In a market context that is still challenging, the strategy to accelerate our launches of new models is delivering results. Order intake levels, which have increased significantly since the start of the year, are now once again higher than sales. While dealer inventories have normalized, this turnaround in our commercial development will gradually pave the way for a resumption of growth in revenues as expected over the coming quarters”, confirms Bruno Thivoyon, Chairman of the Executive Board Groupe Beneteau.

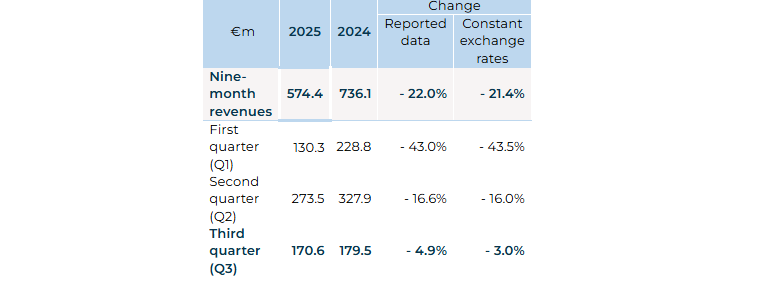

In the third quarter, the Group’s revenues came to €170.7m, down 3% at constant exchange rates. In a boat market still affected by an uncertain macroeconomic context, this performance confirms the turnaround in sales trends observed in the second quarter, with the overall levels of inventory stabilizing within the distribution networks since the end of the first half of the year (versus a reduction of over €30m in Q3 2024).

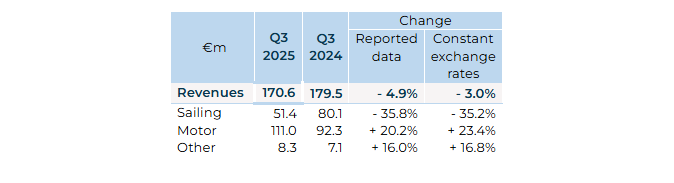

Contrasting Q3 sales trends depending on the business segment

For the Motor business, sales rose by 23% at constant exchange rates in the third quarter, after deliveries were affected by destocking for over €30m in the third quarter of 2024. In the Motor Yachting segments, the PRESTIGE brand’s multihull sales continued building on their strong progress, while the BENETEAU Swift Trawler 54, launched at the 2024 Cannes show, also supported the robust development of this entire range. In the Dayboating segments, sales benefited primarily from the success of large units such as JEANNEAU’s Merry Fisher 1295 and the award-winning new 38 T-TOP from WELLCRAFT.

For the Sailing business, revenues contracted by 36%, still affected by the slowdown in demand from charter professionals (-47%), as well as the wait-and-see approach that has continued to be seen across the monohull sailing segments, with deliveries reduced by half during the quarter. In the multihull segments, the success of the latest new models, such as the Lagoon 43 and more recently the Excess 13 and Lagoon 38, made it possible, once again this quarter, to revitalize a market that is normalizing.

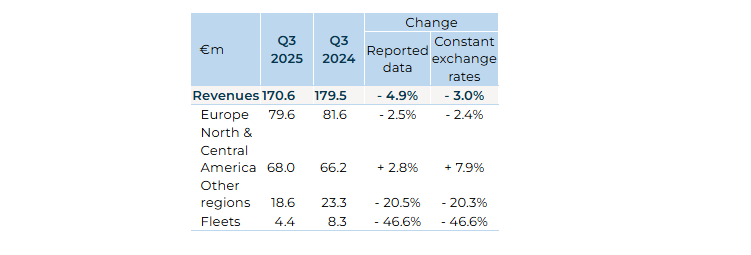

Gradual upturn across the regions

In North America, activity picked up (+8% at constant exchange rates) in a context of inventory levels stabilizing within the networks, primarily in the Dayboating segments. Demand for sailing units and motor yachts in the United States continued to be restricted by the tariffs of nearly 15% introduced, as well as an unfavorable change in €/$ exchange rates, increasing the price of these boats imported from Europe.

In Europe, in a region where sailing models represent a significant percentage of the Group's sales, growth in motorboat sales was not sufficient to return to growth this quarter. However, the Group’s presence across all the segments, with a well-established distribution network covering this continent’s various boating areas, has helped mitigate the reduction in demand in certain countries such as France.

Outlook

While boat markets are still uncertain, the acceleration of new product launches is enabling the Group to revitalize demand across all the various segments. This strategy has proven particularly successful during the season’s first shows. Order intake levels continued to accelerate in the third quarter, driven by the success of the 23 new models presented at the Cannes show, which have contributed nearly one third of all the orders received since the start of the year. These new models have helped respond to expectations for increased accessibility, as with the Beneteau First 30, Swift Trawler 37 and Prestige F4.3, as well as the continued premiumization achieved on the premium segments, with the Beneteau Oceanis 47 and 52 for Monohull Sailing and the new Gran Turismo range and the Prestige M7 for Motor Yachting.

With order intake levels becoming higher than sales again, the results of this strategy confirm the outlook for a gradual return to sales growth over the coming quarters. Based on this expected turnaround, the fourth-quarter revenue forecast is now around €300m (vs. €298m in Q4 2024). This forecast takes into account the slowdown linked to the tariffs rolled out in the United States and a cautious European market, leading to a higher level of promotional intensity than in 2024. Reflecting this gradual recovery in business, the Group expects its income from ordinary operations to be positive for the second half of the year, partly offsetting the loss recorded for the first half.

The Paris boat show, which will once again open its doors from November 26 to 30, 2025 in Le Bourget, followed by the Düsseldorf and Miami shows in early 2026, will enable the Group to better qualify changes in demand for each segment for the whole of the 2025-2026 season.

Services activities developing

Alongside the acceleration of its product plan, the Group is continuing to move forward with its development of services and has completed its acquisition of BMS. Looking beyond the €3m of full-year revenues expected for 2025, the integration of this service center will act primarily as a driving force to develop the Group’s premium offering and better support owners throughout the lifecycle of their large units.

In the United States, the challenging situation for Dayboating has not yet allowed Your Boat Club (49% owned by the Group) to turn around its profitability, with some of its banking creditors calling on Groupe Beneteau’s guarantees for around €1m. The Group is currently looking into several scenarios regarding the future direction of this service business in the United States.