Massimo Perotti

Massimo Perotti: twenty years of Sanlorenzo, from relaunch to global leadership

In 2005, Massimo Perotti acquired Sanlorenzo, a historic brand in Italian yacht building, launching a relaunch process that in two decades has turned the company into a leading force in the international yacht industry. Today, Sanlorenzo is a holding company listed on the Milan Stock Exchange, with motor yacht and superyacht lines built in composite and metal, and with a strategic presence in sailing through Nautor Swan, the Finnish yard acquired just one year ago. On the occasion of this important milestone, we interviewed Cav. Perotti to review the key stages of his industrial project and to understand what scenarios lie ahead for the Group. An opportunity to reflect on the evolution of the market, the path to sustainability, and the identity of a shipyard that has successfully combined craftsmanship and strategic vision.

PressMare – In 2005, you acquired a brand with a solid reputation but in need of relaunching its range and internationalizing the product. What was your vision at the time, and what strategic decisions do you consider to have been decisive for Sanlorenzo’s growth?

Massimo Perotti – I already had over twenty years of experience in the sector. I knew Sanlorenzo well: a brand of the highest quality, with refined design and great attention to detail, but with an exclusive boutique-like approach, 40 million in revenues and seven boats per year. The company was strongly tied to its founder, who did not speak English and distributed almost exclusively in the Mediterranean. I saw the opportunity to acquire an artisanal excellence and make it grow.

PM – Sanlorenzo immediately changed pace…

MP – From 2004 to 2008 we went from 40 to 200 million in revenues, expanding the range and opening new markets such as Asia-Pacific, the Americas, and Central Europe. The product did not change much at first; we initially internationalized distribution. Only later did we adapt the product to the specific requirements of certain markets, such as the U.S., which demands different electrical standards and dedicated layouts.

PM – Then came the 2008 crisis. How did you deal with it?

MP – It was a difficult time for the entire boating industry, but Sanlorenzo remained stable at 200 million until 2013, when we decided to profoundly innovate the product. We brought in designers such as Rodolfo Dordoni, Antonio Citterio, Patricia Urquiola, Christian Liaigre and, from 2015, Piero Lissoni, who became our art director in 2018.

Lissoni also played a crucial role in communication renewal: he pushed us to abandon the classic rhetoric of sun and sea for a more contemporary language, based on neutral tones and elegant settings. Our boat show stands followed this new vision as well, inspired by industrial sites and historic architecture.

PM – Has the business model impacted Sanlorenzo’s resilience?

MP – Absolutely. From the very beginning I wanted to concentrate production above 24 meters, where competition is lower and the market less cyclical. Selling boats under that threshold means dealing with clients more sensitive to economic cycles. Instead, we work with ultra-high net worth individuals: today our average price per unit sold is around 12 million euros. The core business, Sanlorenzo, represents 80% of revenues; Bluegame, operating in the under-24-meter segment, accounts for 10%, and the recently acquired Nautor Swan another 10%.

PM – Do the new U.S. tariffs, officially confirmed yesterday at 15%, concern Sanlorenzo?

MP – The impact is minimal: 20% of our business involves the American continent, but only half of those boats actually end up in the U.S., and even fewer are under 30 meters, thus subject to tariffs. We are therefore talking about an actual exposure of 5%. Moreover, many large yachts purchased by American clients are registered under foreign flags and mainly used in the Mediterranean or the Caribbean. Traditional U.S. yacht builders above 30 meters have almost disappeared, and American clients now turn to European shipyards, with Italy increasingly leading the market.

PM – What is the industrial approach to managing different materials and segments, between composite and metal?

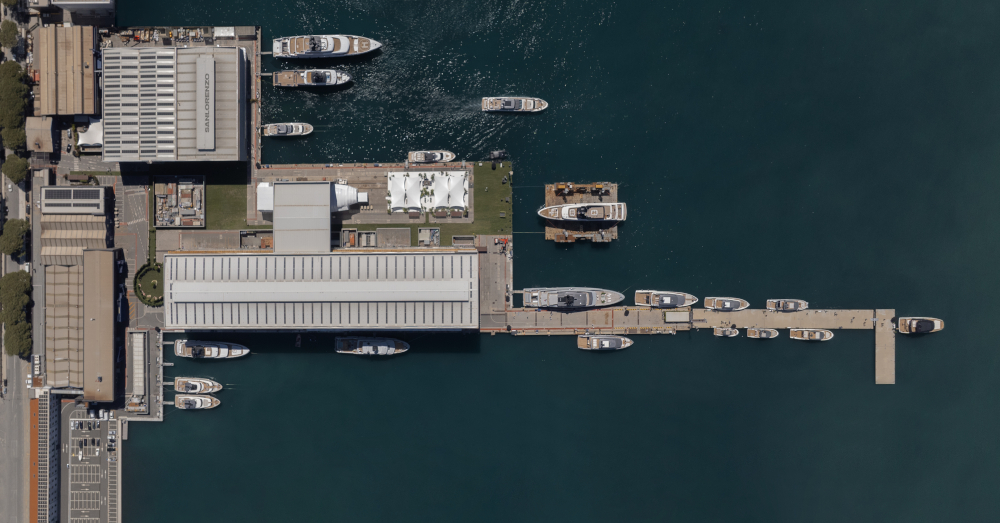

MP – We handle complexity with dedicated structures and resources. Composite yachts (24–40 meters) are built in specific sites between Ameglia, Massa, and Viareggio, with distinct technical and operational staff. Metal superyachts (44–74 meters) are managed between Pisa and La Spezia, with a centralized supply chain where possible, but separate organizations. This allows us to maintain both efficiency and customization, consistent with our “made to measure” approach.

PM – Has listing on the Stock Exchange changed the way you run the business?

MP – Yes, it has brought rigor, transparency, and a stronger reputation with clients, suppliers, employees, shareholders, and financial institutions. Being listed requires quarterly reporting, imposing constant management control. It has also strengthened management retention through tools such as stock options, linking company performance to people’s value. This has become a crucial factor in attracting and retaining talent.

PM – You also mentioned succession. How does this reflect on corporate governance?

MP – Being listed means ensuring continuity without family constraints. My children work in the company, but they are not obliged to. If one day they decided to remain only shareholders, the company could be managed by professional managers. It is a virtuous balance: those who want to stay will have to deserve it.

PM – Sanlorenzo has expanded its strategic perimeter with the acquisitions of Bluegame and Nautor Swan. Are industrial synergies materializing among these brands, and what benefits do they bring?

MP – Absolutely, especially between Bluegame and Nautor Swan for the motor division. We are building a new 11,000 sqm facility in Brescia: half will be dedicated to Bluegame models, the other half to Nautor Swan motor models. This project represents the first true operational collaboration among the three brands. The site is located in an area with a strong nautical production tradition: between Brescia and Bergamo, many historic companies are based, such as Riva and Cranchi.

PM – What were the reasons behind choosing Brescia?

MP – Brescia and Bergamo offer an exceptional production environment. While slightly more expensive than the Italian average, they provide important logistical advantages: proximity to Milan, major transport routes, and high industrial efficiency. In yachting, where value lies more in innovation, design, and service than in labor cost savings, this territory is ideal. Our segment is not about the price of a single component, but about the uniqueness and quality of the product.

PM – Are there already production activities in that area?

MP – Yes, two years ago we acquired 60% of I.C. Yacht, a small Brescia-based company specialized in tenders. They work excellently: they even won the award for best tender in the world for a Lürssen superyacht. The new facility will rise right in front of I.C. Yacht, on a 22,000 sqm area. By the end of the year, we expect construction to start on the new plant, which will be the production base for new Bluegame and Nautor Swan motor models.

PM – Regarding sailing, what developments are planned?

MP – We are working to improve productivity in Finland, where Nautor Swan builds its sailing yachts. We want to maintain Finnish quality while reducing costs to improve profitability.

PM – From a design perspective, what synergies exist between sailing yachts and motor yachts?

MP – To date, synergies are mainly managerial, procurement-related, and involve sharing know-how, processes, technologies, and financial structures.

PM – Can you tell us more about the new Swan Alloy project?

MP – The project has started. It is a 44-meter designed by Malcolm McKeon, one of the best designers in the sailing world. It will be the first Maxi Swan built in Italy, with the aluminum hull built in the Netherlands by a top-level yard, capable of guaranteeing surface tolerances under 0.3 mm over 6 meters. The quality level will be extremely high. Interiors will be completed in Viareggio, thanks to former Perini master craftsmen with deep expertise in high-end sailing yachts. Launch is scheduled for summer 2028.

PM – Why not build it in Finland, like the other Swans?

MP – It would not have been possible. In Finland we build in composites up to 40 meters; beyond that size, one-off construction is required, where aluminum is more suitable. Moreover, Nautor Swan has no experience with aluminum. We therefore decided to create a new division called Swan Alloy, with the first models at 44, 50, and 56 meters.

PM – Let’s move on to sustainability. What solutions have you already adopted, and what are the future prospects?

MP – In 2024 we were the first in the world to launch a 50-meter with fuel cells, converting methanol into hydrogen and then into electricity. It was a learning experience. In parallel, we developed a foiling tender for the America’s Cup, also hydrogen-powered. We are now working on a bi-fuel engine (methanol and diesel) in partnership with MAN, to be installed on a 50-meter, but we are considering postponing installation to 2029–2030 due to uncertainty about the distribution of green methanol.

PM – So the problem is not technology, but logistics?

MP – Exactly. The technology is ready, but the distribution network for green methanol – produced from renewable sources – is lacking. Without widespread distribution, no one will buy these yachts. That is why we are considering waiting 12–24 months to see if the Western world will provide the necessary push. After his re-election, Trump slowed down U.S. commitment to energy transition.

PM – What is Sanlorenzo’s vision for yachting in 2045?

MP – The vision of future yachting is consistent with the technological development of the product. Since acquiring Sanlorenzo, we have focused on innovation of the existing product; from 2012 to 2022 we focused on design and art. From 2021 we began a new ten-year cycle dedicated to sustainability, which we call “Road to 2030”. The acquisition of Nautor Swan in 2024 is also part of this strategy; it is an investment to be ready, with new ranges, to meet the demands of a more environmentally conscious market.

PM – Do you believe young people will be the key to this transformation?

MP – Yes, today’s thirty-year-olds – tomorrow’s forty-year-olds – are attentive to climate change, consumption, and sustainability, even in small daily choices. They are the future of our market, and we must be ready.

©PressMare - All rights reserved